Greenwashing to get funds? No! Just green it.

In the recent past as entities enter into contracts, every contract document worth its salt will have a force majeure clause.

As per Meriam webster Dictionary,

“Force majeure translates literally from French as superior force.

In business circles, "force majeure" describes those uncontrollable events (such as war, labor stoppages, or extreme weather) that are not the fault of any party and that make it difficult or impossible to carry out normal business. A company may insert a force majeure clause into a contract to absolve itself from liability in the event it cannot fulfill the terms of a contract (or if attempting to do so will result in loss or damage of goods) for reasons beyond its control.”

At the time of contracting, parties operate behind the illusion of what may or may not constitute force majeure events. With climate change and its adverse effects, there is no telling when these events may arise. Climate change has been attributed to wild fires, erratic storms and rains which may frustrate performance of contracts leading to a number of courts and tribunals giving effect to the force majeure clauses.

The discussion currently is whether to draft the clauses in a narrow or broad manner to pre - empty effects of climate change as acts of God.

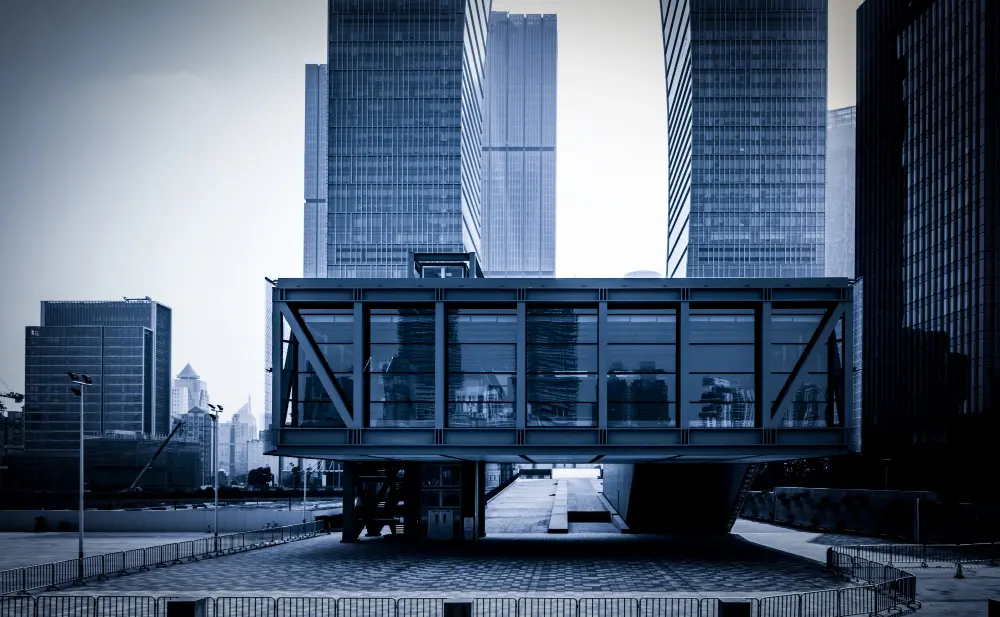

Climate change and its effects is something all of us can relate to. Discussions such as the ones happening at the Africa Climate Summit 2023 currently on in Nairobi Kenya is testament enough that we have been driven to the wall. The theme of the summit is Driving Green Growth & Climate Finance Solutions for Africa and the World.

One of the key agenda for the summit centers around climate action financing with the global community seeking to commit to achieve three climate finance goals of more financing, targeted financing, and cheaper higher risk appetite financing.

Going by media reports, the summit has attracted a number of attendees from diverse walks of life. Without a doubt we have a good pool of investors in the summit seeking out opportunities for green investing. Green finance will be an agenda item on this summit table.

The big question for businesses and organizations is whether you are eligible to tap into green financing?

For investors and financiers, we will also be looking to see whether you are truly committed to the Environmental, Social and Governance (ESG) journey.

Greenwashing entails corporates making themselves out to be more environmentally friendly than they actually are. In greenwashing entities make false or misleading statements about the environmental benefits of a product or practice.

For instance, when financial institutions dedicate funds towards green financing yet a major stake of their funding portfolio goes into enabling activities that are injurious to the environment, they are guilty of greenwashing.

Or when you get a company that manufactures plastic products with recycling labels in their packaging yet they know very well that particular type of plastic is hard to recycle.

When it comes to green investing, the sword is not just double-edged, pointing to the green investors and owner of business in need of capital. It is multifaceted. It cuts through the long-held notions of the investor, the owners of businesses and the complacent consumer. A consumer should be able to read through the subtle nuances of greenwashing by both the owners of capital and the recipient of green funds and call out acts of green washing.

Be that as it may when it comes to the ESG journey, we need to start somewhere. Tackling climate change and the myriad of climate change actions proposed towards building resilience, adaptation and mitigation environmental require massive resources, especially financial resources. Green financing is here with us. Your business should take every necessary step to tap into these finances.

It is not late for your business and organization to truly start on the green journey. You do not have to green wash to tap into these opportunities. Talk to us. Procunomics Limited has experts who will walk your business through the ESG journey, ensure real compliance for you to tap into the vast resources that have been unlocked towards green financing.

Written by Stella Amisi Orengo